GBP/USD Price Analysis: Refreshes two-week low ahead of BOE

- GBP/USD drops after the break of the monthly support line.

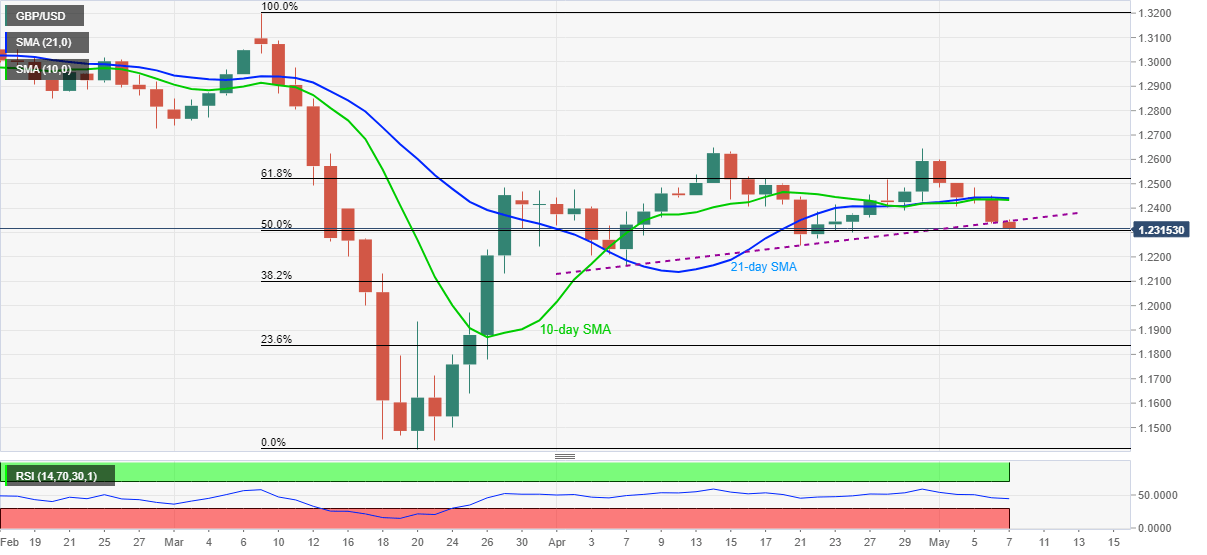

- 21/10-day SMA confluence adds to the resistance.

- April low on the sellers’ radars.

Having slipped below the monthly support line, now resistance, GBP/USD declines to 1.2315 during Thursday’s Asian session. The pair flashes two-week low while testing 50% Fibonacci retracement of its March month downside.

Hence, a sustained break below 1.2310, comprising 50% Fibonacci retracement, can aim for April 21 low around 1.2250/45 for a pause before targeting the previous month's bottom near 1.2165.

In a case where the bears dominate past-1.2165, 1.2000 round-figure could be on their radars.

Meanwhile, a confluence of 21 and 10-day SMA around 1.2440 can limit the pair’s recoveries beyond the support-turned-resistance line of 1.2345.

Also likely to challenge the buyers are 61.8% Fibonacci retracement and April month high, respectively around 1.2520 and 1.2650.

GBP/USD daily chart

Trend: Further downside expected