Back

20 Jul 2021

Crude Oil Futures: Door open for a near-term rebound

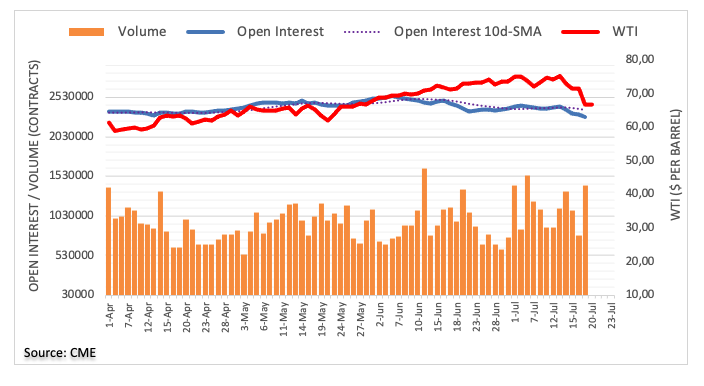

CME Group’s flash data for crude oil futures markets noted open interest shrank for the fourth session in a row on Monday, this time by around 23.7K contracts. On the other hand, volume reversed two consecutive daily pullbacks and went up by nearly 625K contracts.

WTI now looks to regain $70.00

Prices of the WTI collapsed to the $66.00 region on Monday. The sharp selloff was on the back of shrinking open interest, which is supportive of some recovery in the short-term horizon. The current oversold condition of the commodity also supports this view. The next target on the upside emerges at the key $70.00 mark per barrel, where also coincides the 50-day SMA.